Top 11 Industrial Sectors in Bangladesh

Md. Joynal Abdin*

Business Consultant & Digital Marketer

Co-Founder & CEO of Bangladesh Trade Center

The government of Bangladesh has classified the industries into twelve different segments. These are:

Large Industry:

- In manufacturing: ‘large industry’ will be deemed to comprise enterprises with either the value (replacement cost) of fixed assets excluding land and building in excess of Tk. 500 million or more than 300 workers. For the readymade garment/labor-intensive sector, large manufacturing units should excess of 1000 workers in number [7].

- For services: ‘large industry’ will correspond to enterprises with either the value (replacement cost) of fixed assets excluding land and building in excess of Tk. 300 million or with more than 120 workers.

Medium Industry:

- In manufacturing: ‘medium industry’ will be deemed to comprise enterprises with either the value (replacement cost) of fixed assets excluding land and building between Tk. 150 million and Tk. 500 million, or with between 121 and 300 workers. But, for readymade garment/labor-intensive sector medium manufacturing units should have less than or equal to 1000 workers in number.

- For services: ‘medium industry’ will correspond to enterprises with either the value (replacement cost) of fixed assets excluding land and building between Tk. 20 million and Tk. 300 million, or with between 51 and 120 workers.

Note: If on one criterion, a firm fall into the ‘medium’ category, while it falls into the ‘large’ category based on the other criterion, the firm will be deemed as in the ‘large’ category.

Small Industry:

- In manufacturing: ‘small industry’ will be deemed to comprise enterprises with either the value (replacement cost) of fixed assets excluding land and building between Tk.7.5 million and Tk. 150 million or between 31 and 120 workers.

- For services: ‘small industry’ will correspond to enterprises with either the value (replacement cost) of fixed assets excluding land and building between Tk. 1 million and Tk. 20 million, or with between 16 and 50 workers.

Note: If on one criterion, a firm fall into the ‘small’ category, while it falls into the ‘medium’ category based on the other criterion, the firm will be deemed as in the ‘medium’ category.

Micro Industry:

- In manufacturing: ‘micro industry’ will be deemed to comprise enterprises with either the value (replacement cost) of fixed assets excluding land and building between Tk. 1 million and Tk. 7.5 million, or with between 16 and 34, or smaller number of,

- For services: ‘micro industry’ will be deemed to comprise enterprises with either the value (replacement cost) of fixed assets excluding land and building less than Tk. 1 million or with not more than 15 workers.

Note: If on one criterion, a firm fall into the ‘micro’ category, while it falls into the ‘small’ category based on the other criterion, the firm will be deemed as in the ‘small’ category.

Cottage Industry:

The cottage industry will be deemed to comprise enterprises with either the value (replacement cost) of fixed assets excluding land and building of less than Tk. 1 million or with up to 15 workers, including household members.

Note: If on one criterion, a firm fall into the ‘cottage’ category, while it falls into the ‘micro’ category based on the other criterion, the firm will be deemed as in the ‘micro’ category.

Handicraft Industry:

The handicraft industry will be deemed to comprise enterprises with massive use of the talent of a craftsman or by getting knowledge from previous generations, using modern technology, or being trained produce unique and useful products.

High-tech Industry:

High-tech Industry will include industrial enterprises dealing with knowledge and capital-driven high-tech environment-friendly and IT/ITES/biotechnology or Research and Development.

Creative Industry:

The creative industry comprises the products produced by using the talent of artists, using modern machinery or techniques. Such as advertising, architecture, art, antic, design, fashion design, film and video, interactive laser software, performing art, music, publishing, software, and computer media program, etc.

Reserved Industry:

Industries that are kept reserved for public investment due to national security or other reasons have been termed reserved industries.

High-priority Sector:

High-priority industries are the sectors having quick growth potentials, employment generation, and export potentials. These sectors will enjoy various government support for faster development of the sectors.

Priority Sector:

Priority sectors are the sectors having faster growth and export potential. A list of priority sectors will be declared by the government from time to time.

Controlled Industry:

To provide service/entertainment and ensure maximum exploitation of natural/mineral resources, private enterprises may be recognized with appropriate government decisions, and industries that might cast a negative impact on the economy, or cause threat to national security and culture can be set up with approval/NOC from the pertinent ministry/commission (e.g. Ministry of Religion/culture, BRTC, etc.) as well. The government will prepare a list of controlled enterprises taking into consideration the state of affairs. In addition, approval is to be made following the Private Sector Infrastructure Guidelines in case of private infrastructural projects e.g. flyovers, elevated expressways, monorail, underground rail, economic zone, etc. In tabular format this classification could be shown as follows:

Table – 1: Classification of Industries in Bangladesh

| SI | Type of Industry | Replacement excluding land and factory buildings | Number of employed workers | |

| 1. | Cottage Industry | Below BDT 1 million | Not exceed 15 | |

| 2. | Micro Industry | Manufacturing | BDT 1 million to 7.5 million | 16 to 30 |

| Service | Below BDT 1 million | Not exceed 15 | ||

| 3. | Small Industry | Manufacturing | BDT 7.5 million to 150 million | 31 to 120 |

| Service | BDT 1 million to 20 million | 16 to 50 | ||

| 4. | Medium Industry | Manufacturing | BDT more than 150 million to 500 million | 121 to 300 /

But for RMG / labor intensive industry not more than 1000 |

| Service | BDT more than 20 million to 300 million | 51 to 120 | ||

| 5. | Large Industry | Manufacturing | BDT more than 500 million | More than 300 /

But for RMG / labor-intensive industry more than 1000 |

| Service | BDT more than 300 million | More than 120 | ||

Source: National Industrial Policy 2016.

Different Sectors of Bangladesh’s Economy

Major sectors of Bangladesh’s economy could be classified into three broad heads, namely industrial (manufacturing) sectors, Service sectors, and agriculture (agro-processing) sectors. Major sectors of Bangladesh’s economy are as follows:

Industrial (Manufacturing) Sectors of Bangladesh:

- The agro-based and agro-processing industry

- Readymade Garments Industry

- Pharmaceuticals

- Leather and Leather products

- Light Engineering Industry

- Jute and Jute products

- Plastic Industry

- Ship Building

- Environment-friendly shipbreaking

- Frozen Fish Industry

- Home Textiles

- Renewable Energy (Solar Power, Windmill)

- Active Pharmaceuticals Ingredient Industry and Radio Pharmaceuticals Industry

- Herbal Medicinal Plant

- Basic chemicals/dye and chemicals

- Radio-active (diffusion) Application Industry (e.g. developing quality of decaying polymer/preservation of food/ disinfecting medicinal equipment)

- Development of the Polymer Industry

- Automobile Industry

- Handicrafts

- Energy Efficient Appliances/Manufacturing of Electronic goods/Development of Electronic materials

- Tea Industry

- Ceramics

- Tissue Grafting and Biotechnology

- Jewelry

- Toy

- Cosmetics and toiletries

- Agar –Ator Industry

- Furniture

- Cement Industry

Major Service Sectors:

- IT-based activities (system analysis, design, developing system solutions, information service, call center service, offshore development Centre, business process outsourcing, etc.)

- Agro-based activities such as fishing, fish preservation, and marketing

- Construction industry and housing

- Overseas Employment

- Entertainment

- Ginning and baling

- Hospitals and clinics

- Nuclear and Analytical Services (e.g. nuclear treatment etc.)

- Horticulture, flower cultivation, and flower marketing

- Human Resource Development, Knowledge society with high-quality merit and efficiency

- Tourism

- Testing Laboratory

- Photography

- Telecommunication

- Transport and communication

- Warehouse and container service

- Engineering Consultancy

- Filling Stations (Petrol pump, CNG conversion center, etc.)

- Private Inland Container Depot and Container Freight Station

- Tank Terminal

- Chain Super Market/Shopping Mall

- Aviation Service

- Inspection and testing service

- Regional Feeder vessel and coastal ship service.

- Dry docking and ship servicing

- Modernized Cleaning Service for High-rise Apartments, Commercial Building

- Auto mobile service

- Technical Vocational Institute

- Production and Marketing of poultry and dairy products

- Advertising Industry and modeling e.g. print modeling, TV commercials, ramp modeling, catwalk, fashion

- Production, supply, and distribution of power in the private sector

- Outsourcing and Security Service (Private Security forces/manpower supply)

- Sea-ship movement trade

Agriculture (agro-processing) Sectors:

- Processed fruit products (jam, jelly, juice, pickles, acrobat, syrup, sauce, etc.)

- Fruits processing (tomato, guava, sugarcane, jackfruit, lychee, pineapple, coconut, etc.) vegetables and lentil

- Processing of bread and biscuits, vermicelli, laccha, chanachur, noodles, etc.

- Manufacturing of flour, sujee

- Processing of mushroom and spirulina

- starch, glucose, and other dextrose product

- Milk Processing (pasteurization, milk powder, ice cream, condensed milk, sweet, cheese, butter, ghee, chocolate, curd, etc.)

- Processing of Potato products (chips, potato, flex, starch, etc.)

- processing of powdered spice

- Refining and hydrogenation of edible oil

- Salt processing

- Processing of prawns and other fishes and freezing

- Manufacturing of herbal cosmetics

- Manufacturing of Unani and Ayurvedic medicines

- Fish feed and fish meal processing for poultry and livestock

- Seed processing and preservation

- Manufacturing of jute products (rope, thread, twain, canvas, bag, carpet, sandals, etc.)

- Production of silk textile

- Manufacturing of agro-equipments

- Manufacturing of rice, puffed rice, chirra, etc.

- Production of flavored rice

- Tea processing

- Production of coconut oil

- Processing of rubber tape, shellac

- Cold storage (processing and preservation of edible potato and seed potato, fruits, vegetables, etc.)

- Production of wood, bamboo, and cane furniture (exclusive of cottage industry)

- Flower preservation and export

- Meat processing

- Production of Bio slurry, mixed manure, and urea

- Production of bio-pesticides, neem pesticides, etc.

- apiculture

- Particle board

- Sweetening products

- Soya food production & processing

- Mustard oil producing industry (if local variety is used)

- Rubber goods-making project.

- Rice bran oil.

- Seed industry

- Milk and poultry production and supply.

- Horticulture, floriculture, flower cultivation, and flower and vegetable marketing (lemon, mushroom, battle leaf, and honey are included in this industry).

Industrial (Manufacturing) Sectors of Bangladesh

The contribution of the industry sector to GDP is progressively increasing in Bangladesh. According to the BBS, the contribution of the broad industry sector to GDP has been estimated at 31.28 percent in FY 2015-16, which was 30.42 percent in FY 2014-15.

In order to accelerate the pace of industrialization of the country, the formulation of the National Industrial Policy 2016 is under process. The important and underlying objectives of the Industrial Policy 2016 include sustainable and inclusive industrial growth through the generation of productive employment to create new entrepreneurs, main-streaming women in the industrialization process, and international market linkage creation.

The Government is continuing its efforts to achieve this goal by providing loans and other ancillary support through banks and other financial institutions. As a result, the volume of both distribution and recovery of industrial loans is on the increase. The EPZs are playing a special role in the process of promoting rapid industrialization and attracting foreign direct investment. Both investment and exports in the EPZs are increasing gradually. In FY 2014-15, the total amount of investment in EPZs stood at US$406.35 million, which is 0.98 percent higher than the investment made at the same time in the previous fiscal year. On the other hand, EPZs exported goods worth of US$ 6.11 billion in FY 2014-15 which was US$5.52 billion in FY 2013-14. Most promising Bangladeshi industrial sectors are described as follows:

Top 11 Industrial Sectors in Bangladesh, this is the summary of two chapters of the book “The Mirror of Bangladesh Economy” of the Author. To purchase the book click here.

- Electrical and Electronics Sector:

There were a few electrical companies in Bangladesh before its independence in 1971 these are Sun Shine Cable Industry, Ever Shine Cable Industry, Facto Industries Limited, Gazi Ware Limited, and General Electric Company etc. Soon after the independence (1972-78) some courageous entrepreneurs came forward to invest in the electrical industry of Bangladesh. Eastern Cables, Shihan Cables, Uzzal Plastic Industries, Shamol Electric Industries, General Electrical Industries, Tritorit Industries, MEP, and Comrade Backlight Industries Limited are renowned names.

During 1978-86 this industry attracted another about 1000 investors in this sector. Currently, there are about 2500 companies producing electrical goods in Bangladesh. The electrical sector of Bangladesh can be divided into six sub-sectors based on the product produced. Sub-sectors are Electric fan sub-sector, Electric Cables, Light fittings, backlight, Electric motor, Generator and transformer, and Electricity distribution equipment sub-sectors.

Products produced:

This sector can be divided into two major sub-sector based on the uses of the products. These are the industrial products sub-sector and the household product sub-sector. Industrial products are Electric cables, distribution boards, large and medium transformers, switchgear, sub-station equipment, electric arc welding machine, enameled ware, insulator, industrial fan, heat and speed control system, magnetic contactors, Parceling bright connectors, different connecting equipment, main switch, electric iron and shouldering iron, etc.

Household products produced by the Bangladesh electrical sector are Ceiling fans, table fans, adjust fans, tube lights, filament bulbs, light fittings, table lamps, different laps, distribution boards, electric meters, switches, plug, water heater, florescent light ballast, light & fan controller, torchlight, refrigerator, lift equipment, extension cord, and energy saving lamp, etc.

Current Trend:

In the last few years this sector earned double-digit growth and it has a very potential export market throughout the world. Bangladesh is mainly producing electrical products of HS chapters – 84, 85, 90, and 94. The global market for these products is growing by multiple digits except recent negative trend of the global financial crisis in 2009. There are few natural and one manmade cluster of electrical products in Bangladesh.

Major importers of electrical products (Bangladesh does produce) are the USA, Canada, Germany, Australia, Mexico, Italy, Denmark, Hong Kong, France, and Finland. Major exporters of these products are China, USA, Germany, Japan, Singapore, South Korea, Taipei, Mexico, Netherlands, and Malaysia.

Electrical products are very sensitive in nature. Single trouble may be the cause of massive damage to wealth and even human life. So everybody wants to be ensured that the products they are using are qualitative. As a result, electrical products need different mandatory certifications before exporting those products to different countries of the world. For example, EU countries want the “CE” mark, Japan wants “Diamond PSE Cat. A & B”, China wants “CCC” and India wants the “ISI” marking before entering electrical products in the respective countries.

From the last six years’ statistics, we observe that Bangladesh’s electrical sector is growing 38-42% per year. Not only is the local market increasing but global demand for electrical products also rising rapidly. In 2009 electrical products production rate increased by 22% in Europe, 21% in North America, 14.5% in Japan, 24.3% in China, 13.1% in Asia Pacific, and 5.1% in the rest of the world. Bangladesh is importing a large portion of electrical products to meet its additional demand.

Currently, 47% of the total population of Bangladesh is linked to the national grid of electricity. The per capita rate of electricity generation is 220Kwh which is much lower than any other developing country of the world. In such an environment local demand for electrical products is about 20 thousand crore taka.

This demand for electrical products will go up with the economic development and increase of electricity supply. The government of Bangladesh announced a roadmap of electricity generation to add another 1650 MW by the end of 2011, 4995 MW by the end of 2013, and 9364 MW by the end of 2015 in the national grid. The government is also planning to be self-sufficient in electricity and supply this to 100% population of the country by the end of 2017.

If this planning be implemented in time then local demand for electrical product will grow up geometrically up to 60 thousand crore taka. On the other hand export poetical of electrical products is also growing similarly. Bangladesh is enjoying duty-free and quota-free market access in the EU, Australia, Canada, and other developed countries. So the export prospect of this sector is more positive than any non-LDC competitors. Finally, we can say that there is enormous growth potential in the Bangladeshi electrical sector in the coming days.

Problems of the Bangladeshi electrical industry:

- Under invoicing during import of finished electrical products.

- Lack of advanced technological and technical knowledge.

- Absence of IP protection mechanism in action.

- Lack of infrastructure to enter into the export market with electrical goods.

- Quality flexibilities on imported poor quality products.

- Absence of an electrical testing laboratory and research center.

- Absence of product development and design center.

- Lack of skilled manpower & sector-specific training center.

- Low productivity.

- Insufficiency of bank loan.

- Insufficiency of electricity supply.

Recommendations:

Short-term recommendations are (implementable by the next 1 year):

- Providing tax holidays to new SMEs in the electrical sector.

- Restructuring and justifying import duties on raw materials and finished goods of this sector.

- Simplification of the process and procedures of VAT credit taken by SME entrepreneurs.

- Active actions to stop under-invoicing.

Mid-term recommendations are (implementable in 1-3 years):

- Ensuring electricity supply during the production period or providing incentives for load shedding.

- Ensuring quota for local products in public procurement.

- Providing a cooperative facility for marketing/export of electrical products.

- Active action to ensure the quality of imported products.

Long-term recommendations are (implementable in 5 years):

- Establishing electrical testing lab & research center.

- Establishing electrical training and design center.

- Imposing IP law to protect innovators.

- Ensuring qualitative raw materials for this sector.

- Facilitating export of electrical products via EPB.

- Increasing use of ICT and e-commerce.

- Providing collateral-free loans to electrical degree holders; who want to be entrepreneurs.

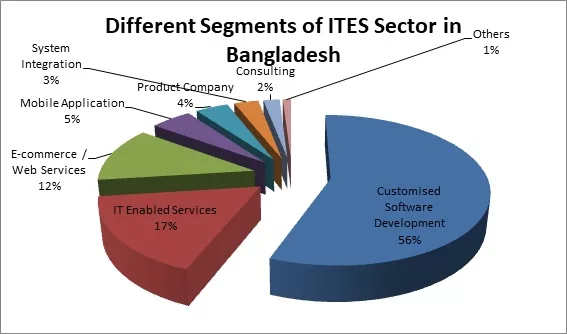

- Software Development Sector:

Software and information technology is one of the most progressive sectors of Bangladesh. According to the BASIS survey, there are over 800 registered software and ITES (IT Enabled Service) companies in Bangladesh. There is another few hundred unregistered small and home-based software and IT ventures to do business for both local and international markets.

The total industry size is estimated to be around Tk. 1,800 crore (US$ 250 million). Approximately 30,000 professionals, the majority of IT and other graduates, are employed in the industry. Though, compared to other traditional mainstream industries, the contribution for overall employment creation is not significantly high, if considered in terms of creating high-quality employment (average monthly compensation over Tk. 15,000 per month), the software and IT service industry is surely one of the top graduate employment sectors in the country.

Product produced:

Some companies are developing web applications based on the cloud delivery model, thus defining a new wave in the IT industry. A large part of this industry provides business application solutions including accounting software, human resource software, office management and security solutions, and sales automation and inventory management systems to the private sector. However, a major focus for most IT companies still continues to be in the banking and other financial sectors.

A new trend is individual/group-based outsourcing, also known as freelancing. These are informal initiatives taken by young IT professionals and students to acquire clients through various online marketing channels. Freelancing activities mainly include software, web design, mobile application, graphic design, search engine optimization, social media marketing, and data processing. Exports from the software and ITES sector were around $100 million in July-May 2012-13.

Current Trend:

Currently, this industry is estimated to be worth around $1.00 billion, where approximately 70,000 professionals, mostly IT graduates, are employed. As per BASIS, there are over 4500 registered software and ITES companies, along with a few hundred unregistered small and home-based software and IT ventures doing business for both local and international markets.

In terms of export destinations, North America (mainly the USA) dominates while the UK, Denmark, and the Netherlands have emerged as major destinations in recent years. Besides regular exports to Australia and Japan, a number of IT companies have also achieved considerable success in mobile-related applications and communications in Malaysia, Singapore, UAE, Saudi Arabia, and South Africa. The IT sector of Bangladesh is expected to reach a target of $1 billion within the next few years.

The software and ITES sector is not only contributing significantly to the national income, but it has also created high-quality employment for young IT graduates. Many tech graduates, some of them returning from abroad after completing their education, have started their own IT ventures over the last few years. In spite of various local and global challenges, these young entrepreneurs have successfully established their businesses. But new software companies often face a lack of government support.

Problems of Bangladeshi Software /ITES Sector:

- The high price of internet bandwidth,

- Absence of submarine cable,

- Lack of infrastructure,

- Absence of skilled human resources

- Absence of software Technology Park,

- Shortage of knowledge about global demands for IT products and services,

- Limited access to finance,

- Lack of confidence,

- The limited number of reference clients etc.

Recommendations:

- Proper implementation of policy reforms for software export,

- Restriction of software import,

- Providing tax waiver for internet use,

- Providing bank loans

- Emphasis on English and software education.

- Light Engineering Sector:

The light engineering sector occupies a unique position in the Bangladesh economy. It prudently acts as a feeder of support industries to all other industries and plays a vital role in the socio-economic development of the country. Therefore, it is known as the mother of heavy industries. This sector has the potential to make a significant contribution towards technological and economic development along with wide opportunities for employment generation.

There are about 40,000 Light Engineering enterprises in all over the country. Around 6 lack people are directly involved with the light engineering sector. It is engaged with production and manufacturing of highly value added engineering goods and services with the value of annual turnover more than TK. 10,000 crore. In recognizing this fact, the government has declared this sector as a thrust sector in its Industry Policy –2010.

Products Produced:

Major products of this sector are Agricultural Machinery & Spares, Motor launch & Marine Transport Spares, Textile Machinery & Spares, Jute Machinery & Spares, Tea plant Machinery & Spares, Construction Machinery & Spares, Bread, Biscuit and Food Processing Machinery & Spares, Metal Furniture, Paper and Pulp Machinery & Spares, Mold & Dies, Components & Spares of Gas Transmission & Distribution, Printing & Packaging Machinery & Spares, Poultry Machinery & Spares, Kitchen Wear & Bathroom Fittings, Metal Product & Hard Ware, LP Gas Cylinder & Fire Extinguisher, and Pharmaceutical Machinery & Spares etc.

The current trend of the sector:

Since the development of the sector, entrepreneurs are providing their products and services to the local market. LES keeps the national economy running by offering cost-effective maintenance services and much-required spares & capital machinery. The light engineering industry has two segments of market i.e. local market and export market. In the local demand, there is a secular growth of around 30% per annum. The size of the local market is around US$ 2 billion.

In the meantime, the local light engineering industry has stepped their presence in export market. The major products include iron sheet, G.I. pipes, cast iron articles, aluminum household articles, iron chains, SS ware, machineries, diesel engine, motor parts, bicycles, light fittings, and dry cell batteries.

Problems of the Bangladeshi Light Engineering Sector:

1) Leading or core assembling companies facing a lack of quality parts suppliers.

2) Lack of modern technology used.

3) Production management skills including TQM are at a low level.

4) Die-making technology is a bottleneck of LEI in Bangladesh.

5) Technical institutions like metal testing, R&D, quality assurance, and accredited inspection lack

6) Marketing ability is insufficient for export promotion.

7) No basic steel industry in Bangladesh.

8) Domestic market becomes reluctant to buy domestic products.

9) No international quality and testing laboratory.

Recommendations:

1) Government could offer special incentives to import-substituting light engineering enterprises.

2) Light engineering technology institute could be established to produce skilled manpower for the sector.

3) Special initiatives could be taken for developing light engineering clusters in Bangladesh.

4) Imposing minimum duty on the import of basic raw materials.

5) Export promotion initiatives could be taken to facilitate the export of light engineering products.

- Agro-processing Sector of Bangladesh:

Agro-Processing is the techno-economic method for producing new products usable for people from the agricultural crops by using machine, applying technology for value addition. The produced new products are named Agro-processed products. Agro-processing sector deals with agro-processed products like food, dairy, fish, fuel, feed, etc. We deal in this report with the agro-processed products which are generally used by people as food. The association, Bangladesh Agro-Processors’ Association (BAPA) is working with those who deal with agro-processed food products.

Product Produced:

In recent years, the entrepreneurs of the agro-processing sector have been able to produce a good number of processed products from the chiefly available local raw materials. Agro-processed products are juice, drinks, biscuit, bread, chanachur, prepared nuts, fried peanuts, potato products- crackers, flakes, chips, starch, etc. rice, flour, flattened and puffed rice, confectionery goods, all kinds of spices, jam-jelly, marmalade, pickles, chutney, all kinds of sauces, vermicelli, rose water, nodules, extruded snacks, fruit bar, candy, bubble gum, loly-pop, kasundi, roti, Parata, purl, spring roll, singara, luchi, samosa, chatpati, chitoi-pitha, molasses, syrup, vinegar of sugarcane and date-juice, honey, cigarettes, biri, jarda, tea, mustard oil, coconut oil, milk powder, fresh milk, mineral water, flavored water, flavored milk, ghee, sweets, active drinks, lemon drinks, khichuri mix, chicken spices, tahari mix, chicken biryani, mutton biryani, jackfruit pickle, oil from rice polishing, vegetable juice, etc.

Current Trend:

The sector accounts for over 22% of all manufacturing production and employs about 20% of labor forces. All food processing enterprises account for 2% of the national GDP. Bangladesh Agro‐processors Association (BAPA) has now 370 members who are engaged in manufacturing, processing and exporting the products of this emerging sector.

From BAPA’s record, in 2011-12, the export was US$ 86.91 million and in 2012-13 the same was US$ 101.49 million. But in 2013-14 the export stood at nearly US$ 153.50 million. At present 100 types of processed food products are exported to nearly 104 countries, which shows the competitive strength of agro-processing sector.

Major importing countries of Bangladeshi agro-processing products are the UAE, KSA, India, UK, USA, Bhutan, Malaysia, Kuwait, Singapore, Qatar, Somalia land, Nepal, Angola, Djibouti, Australia, Bahrain, Ghana, Senegal, Canada, Guinea Bissau, South Africa, Mauritania, Italy, Jordan, Belgium, Liberia, Maldives, Congo, China, Nigeria, Mayotte, Benin, Oman, Japan, Sierra Leone, Cyprus, Ivory Coast, Gambia, Burkina Faso, Sweden, Ecuador, Kenya, Loam Togo, Greece, Afghanistan, Lebanon, Korea, Germany, Iran, Cambodia, Sudan, Hong Kong, Spain, and Mauritius, etc.

Problems of the Bangladeshi Agro-processing Sector:

- Absence of modern machinery, and tools at low cost.

- Limited access to low-cost funds.

- Absence of laboratory facilities for testing of processed agro products at low cost.

- Absence of modern packaging industries for agro-processed products.

- Absence of specialized cold storages for raw materials of agro-processing industries, especially for fruits & vegetables.

- Limited efficiency in production, packaging, quality maintenance, shelf-life, and export documentation of agro-processed products.

- Absence of a specialized multi-disciplinary institute to solve problems related to modern agro-processing techniques & quality control.

- Lack of budgetary allocations for R & D to address all genuine requirements related to issues in the agro-processing sector.

- Lack of standard testing labs and equipment to issue necessary certificates to meet the international requirement for compliance.

Recommendations:

- Skilled manpower has to be developed with production, packaging, quality maintenance, shelf-life, and export documentation skills.

- An easy mechanism of financial support to agro-processors shall be introduced.

- Testing lab services should be available at a low cost.

- A central information Centre should be established to provide online necessary information related to marketing, quality, safety, export, etc.

- Multi-purpose modern packaging industries shall be established for better shelf-life with the necessary information for all types of consumers.

- Agro-processing industrial zone or parks should be established where raw materials like fruits, spices, and vegetables are grown in plenty.

- Tariff and non-tariff barriers related to the agro-processing sector shall be identified and rooted out.

- Export fairs should be arranged for agro-processing products at home and abroad.

- Establishment of specialized cold storage for preserving raw materials.

- A central research-cum training institute should be established for the agro-processing sector.

- Leather and Leather-goods Sector:

The leather and leather goods sector is one of the most potential sectors of Bangladesh’s economy. It employed about 1, 80,000 (One lac eighty thousand) people directly. This sector includes about 3,500 micro, small, and medium leather goods factories with about 110 large industries. This sector is divided into two major heads i.e. leather processing units called tanneries, leather goods like shoes, bags, belts, etc. manufacturers called leather goods factories. There are about 220 to 250 tanneries in Bangladesh mostly located in the Hazaribagh area of Dhaka city. As a Muslim majority country Bangladesh used to produce a huge amount of leathers every year mainly during the Eid ul Azha.

There are a good number of leather goods clusters around the country mainly located in Dhaka, Bhairab, Satkhira, Chittagong, and Brahmanbaria. In Bhairab, about 3000 SME workshops are situated. All of these workshops are dealing with footwear production. Almost all workshops are mostly manual (the lasting process is done by hand). Around 25,000 people are working in these workshops but female employment is almost absent.

Product Produced:

Major Bangladeshi leather goods are pocket or handbags, including purses, wallets, key cases, passport cases, note cases, card cases, cigarette cases, cigar cases, match box cases, hand bags, shopping bags, shoulder bags, document cases, attach cases, belts, wallets, shoe, and foot wears, etc.

Current Trend:

Only 15 – 18 % of the total leather production in Bangladesh can meet up local demand for leather goods. The rest of the amount is export-oriented. The leather and leather goods sector is the fourth largest export-earning sector of Bangladesh. Export earning of this sector is rising with about 48% growth per year. Bangladesh earned USD 1.29 billion by exporting leather goods in the 2013-14 fiscal year. SD Asia forecasted that, very soon this export could be increased to USD 15 billion.

Bangladeshi leather goods are exported into mainly European markets like Germany, Italy, France, Belgium, Sweden, the UK, Austria and Switzerland, etc. Besides these Bangladesh used to export leather goods to the USA, Canada, Japan, China, South Korea, Malaysia, and Singapore.

Problems of Bangladeshi Leather and Leather Goods Sector:

- Lower production capacity.

- Unable to produce bulk amount of same quality products within the shortest lead time.

- Shortage of skilled manpower to expand the industry in the near future.

- Use of traditional technology.

- Absence of R&D for product diversification.

- Lack of initiative for searching for an export market

- Lack of cooperation between the existing enterprises.

- Poor quality of products and low productivity of the existing enterprises.

Recommendations:

- Establishing Common Facility Centres (CFCs) equipped with training facilities.

- Establishment of Leather Goods Training Institute for Developing Skilled Manpower.

- Facilitating technology up-gradation.

- Establishment of a complete product value chain.

- Searching export market and capacity building to comply with buyer’s specification.

- Capacity building of leather sector associations.

- Training up existing manpower with modern equipment for productivity increment.

Top 11 Industrial Sectors in Bangladesh, this is the summary of two chapters of the book “The Mirror of Bangladesh Economy” of the Author. To purchase the book click here.

- Readymade Garments Sector:

Readymade Garment is the leading industrial sector and major export-earning sector of Bangladesh. The apparel industry of Bangladesh started its journey in the 1980s and has come to the position it is in today. The late Nurool Quader Khan was the pioneer of the readymade garment industry in Bangladesh. He had a vision of how to transform the country. In 1978, he sent 130 trainees to South Korea where they learned how to produce readymade garments.

With those trainees, he set up the first factory “Desh Garments” to produce garments for export. At the same time, the late Akhter Mohammad Musa of Bond Garments, the late Mohammad Reazuddin of Reaz Garments, Md. Humayun of Paris Garments, Engineer Mohammad Fazlul Azim of Azim Group, Major (Retd) Abdul Mannan of Sunman Group, M Shamsur Rahman of Stylecraft Limited, the first President of BGMEA, AM Subid Ali of Aristocrat Limited also came forward and established some of the first garment factories in Bangladesh.

Following their footsteps, other prudent and hardworking entrepreneurs started RMG factories in the country. Since then, the Bangladeshi garment industry did not need to look behind. Despite many difficulties faced by the sector over the past years, it has carved a niche in the world market and kept continuing to show robust performance.

Product Produced:

Major apparel items of Bangladesh are Shirts, Trousers, Jackets, T-Shirt, sweaters, etc. Most exported knitwear items are T-shirts, singlets & other vests, knitted or crocheted, of cotton; Jerseys, pullovers, cardigans, waistcoats & similar articles, knitted or crocheted, of textile materials, n.e.s.; Jerseys, pullovers, cardigans, waistcoats & similar articles, knitted or crocheted, of cotton; Men’s or boys’ shirts, knitted or crocheted, of cotton; Women’s or girls’ trousers, bib & brace overalls, breeches & shorts, knitted or crocheted, of cotton; Jerseys, pullovers, cardigans, waist-coats & similar articles, knitted or crocheted, of man-made fibers; T-shirts, singlets & other vests, knitted or crocheted, of textile material other than cotton; Men’s or boys’ trousers, bib & brace overalls, breeches & shorts, knitted or crocheted, of cotton; Women’s or girls’ briefs & panties, knitted or crocheted, of cotton; Men’s or boys’ underpants & briefs, knitted or crocheted, of cotton etc. [8].

Most exported oven items are Men’s or boys’ trousers, bib & brace overalls, breeches & shorts, not knitted or crocheted, of cotton; Women’s or girls’ trousers, bib & brace overalls, breeches & shorts, not knitted or crocheted, of cotton; Men’s or boys’ shirts, not knitted or crocheted, of cotton; Men’s or boys’ shirts, not knitted or crocheted, of textile materials, other than wool, fine animal hair, cotton & man-made fibers; Women’s or girls’ trousers, bib & brace overalls, breeches & shorts, not knitted or crocheted, of textile materials, other than wool, fine animal hair, cotton & synthetic fibers; Women’s or girls’ blouses, shirts & shirt-blouses, not knitted or crocheted, of cotton; Men’s or boys’ trousers, bib & brace overalls, breeches & shorts, not knitted or crocheted, of textile materials, other than wool, fine animal hair, cotton & synthetic fibers; Brassieres of textile materials, whether or not knitted or crocheted; Women’s or girls’ trousers, bib & brace overalls, breeches & shorts, not knitted or crocheted, of synthetic fibers; and Men’s or boys’ anoraks (including ski-jackets), wind-cheaters, wind-jackets & similar articles, not knitted or crocheted, of man-made fibers etc.

Current Trend:

There are more than 5000 garment factories (private statistics) at the current time, employing more than 12 lack laborers, where 85% of the labor force is women. But, according to BGMEA, the number of garment factories in Bangladesh is around 4000. Now, the RMG industry is the country’s largest export earner with a value of over $24.49bn of exports in the last financial year. It’s great news for us that, Bangladesh is clearly ahead of other South Asian suppliers in terms of capacity of the readymade garments industry.

The industry that has changed the lives of millions of people has undergone significant transformation in terms of workplace safety and workers’ rights. National and international reform platforms -National Action Plan (NAP), Accord, and Alliance- have made visible progress to ensure workplace safety. Both Accord and Alliance have completed inspection in 100% of factories and the NAP will complete 100% of factory inspection by this August. We note with satisfaction that less than 2% of the inspected factories have been found vulnerable and closed down immediately. Moreover, to make our progress more transparent and credible, the inspection reports of the factories are made accessible at the Fair Factory Clearinghouse (FFC) database and the websites of the relevant government department, Accord and Alliance. When all factories complete their corrective action plans (CAPs), the RMG industry of Bangladesh can obviously be regarded as the safest industry in the world.

Contribution of the RMG Sector to Bangladesh’s Economy:

It is the single largest employment generator of Bangladesh’s economy. About 80% of total export earnings come from this sector. Statistics shows that, in FY 2003-04 RMG sector of Bangladesh earned US$ 5,686.06 million, in FY 2004-05 the value was US$ 6,417.67.67 million, in FY 2005-06 the value was US$ 7900.80 million, in FY 2006-07 the value was US$ 9,211.23 million, in FY 2007-08 the value was US$ 10,699.80 million, in FY 2008-09 the value was US$ 12.35 billion and finally in FY 2014-15 the value stands at $25.49billion.

Problems of Bangladeshi Readymade Garment Sector:

- Ensuring safety in garment factories.

- Improving the working environment in the factory.

- Diversification of product line as per market demand.

- Providing labor rights in the RMG sector.

- Formalizing the job of millions of workers.

- Regional free trade agreements like TICFA could be a threat to Bangladesh RMG export.

Recommendations:

- Be sure about fire, chemical, and health safety of the factory premises.

- Planning about the number of workers and safe environment per square meter of factory floor.

- Conducting R&D and product diversification study as per demands of the buyers.

- Adopting labor rights and formalizing the worker’s job.

- Be aware of the regional/multilateral free trade movement and be involved with the process.

- Plastics Sector:

The plastic industry in Bangladesh is relatively new compared with the textile and leather industries. The plastic industry began its journey as a small industry in the 1980s. This sector has flourished under the free market economy since the 1990s. There are about 3000 manufacturing units in the plastic sector of which 98% belongs to the Small and Medium Enterprises (SMEs). The plastic sector contributes 1.0 percent of GDP and provides employment for half a million people.

Products Produced:

Major plastic products of Bangladesh are Packaging material, bags, hangers, buckets, jugs, plates, glass, containers, chairs, tables, all kinds of food and non-food packaging, soap case, toothbrush, blood bag, saline bags, injections, medicine container, plastic pipe, door, toilet flush, electrical cables and wires, switches, regulator, computer accessories, telecommunication equipment, plastic pipes for irrigation, and plastic films for shedding crops, etc.

Current Trend:

In 1990 the consumption of plastics was about 14,000 tons. It took 20 years to reach 750,000 tons, an increase of 50 times. At present per capita consumption of plastics in Bangladesh is 5 kg/year as compared with the global average of 30 kg/year. The per capita consumption of ASEAN countries is 17 kg/year. Thus, there is a huge potential for the growth of the plastic industry in the country, if we aspire to become a middle-income country by 2021. The size of the plastic industry in 2021 will be 2.55 million tons per year compared with 0.75 million tons in 2011, an increase of 3.4 times [9].

Plastic products produced in Bangladesh are being exported in two forms- direct export of plastic products and deemed export of plastic products as accessories of apparel products. According to the BPGMEA, the export of plastic products accounted for US$340 million in 2013 of which 75 percent is deemed export and the rest 25 percent is direct export [10]. However, the export data reported by the Export Promotion Bureau (EPB) does not provide information on deemed export of plastic products separately. As a result, its actual contribution to the export basket is not fully come out from the published data. At present the rank of plastic products in the export basket is 12th; but if adjusted with the deemed export, its position will move up to 8th which is above the ranking of raw hides and skins, headgear and parts, mineral fuels, oils, edible fruit, nuts, tobacco, leather products, etc.

Problems of the Bangladeshi Plastic Sector:

- Lack of machinery use and mold manufacturing

- Absence of Troubleshooting professionals in processing machines

- Lack of testing laboratory

- Scarcity of mold design and mold-making professional

- Achieving certification for the export of plastic products

- Absence of technical consultancy services

- Poor management of plastic wastes

- Negative environmental image of plastic industries

Recommendations:

- Upgrading of mold/die-making capabilities

- Basic technical skill development program for plastic goods manufacturing

- Uninterrupted power supply to plastic industries

- Reduce import duty on primary raw materials (polymers) from 5% to near zero.

- Waste management of soiled plastics as RDF and Alternate Fuel (AF).

- Assisting in achieving certificate for export of plastic products

- Setting up of Plastic Industrial Estate

- Healthcare & Diagnostics Sector:

Bangladesh has been making significant socio-economic developments in recent years. Yet, despite improving healthcare indicators such as a decline in mortality rates and an increase in average life expectancy, the health sector of the country is yet to reach its full potential. In fact, Bangladesh is one of the ten countries with the lowest health expenditure. However, reform policies coupled with innovation and investment by the private sector may translate into a rapid rise in this sector.

Service Offered:

- Primary Care: Basic or general health care traditionally provided by doctors trained in family practice, pediatrics, internal medicine, and occasionally gynecology [11].

- Secondary medical care: The medical care provided by a physician who acts as a consultant at the request of the primary physician

- Tertiary Care: Specialized consultative care, usually on referral from primary or secondary medical care personnel, by specialists working in a center that has personnel and facilities for special investigation and treatment.

Current Trend:

According to the Household Income and Expenditure Survey, only a meager 24.6% of Bangladeshi families were covered by the social safety net program in 2010 compared to the global average of almost 60%. Meanwhile, the total number of functional beds is 92,404- which means 0.6 beds per 1000 people against the WHO recommended amount of 3.5 per 1000.

The Bangladeshi healthcare sector could be classified into the following heads:

- Public Sector Health Services:

There are 53 District Hospitals with 7,850-bed facilities, 11 General Hospital with 1,350 beds, 5 infectious disease hospitals with 180 beds, 22 Medical / dental college hospitals with 11,960 beds, 7 Specialized hospitals with 2,330 beds, 1 medical university with 1500 beds [12].

- Private Sector Health Services:

The private sector can be grouped into two main categories. First, the organized private sector (both for-profit and nonprofit) includes qualified practitioners of different systems of medicine. Second, the private informal sector, which consists of providers practicing in rural areas not having any formal qualifications such as untrained allopaths, homeopaths, kobiraj. According to Asia Pacific Observatory on Public Health Systems and Policies, there are 2,983 private hospitals and clinics registered as of 2013. The total number of beds provided by the private sector is 45,485 (as of 2013).

- Diagnostic Centers:

Along with private clinics and hospitals, the number of diagnostic centers in the private sector is growing. In 2012, approximately 5,122 laboratories and other diagnostic centers were registered with the Ministry of Health and Family Welfare (MOHFW, 2012). In the private for-profit sector, there are some large diagnostic centers in the cities (Lab Aid, Ibn Sina, Popular, and Medinova) providing laboratory and specialized radiological tests. Some of these facilities maintain a high standard.

- Donors, NGOs, and Professional Groups:

Bangladesh is known worldwide for having one of the most dynamic NGO sectors, with 2,471 NGOs registered with the NGO Affairs Bureau working in the population, health, and nutrition sectors (as of 2014). NGOs have been active in health promotion and prevention activities, particularly at the community level, and in family planning, and maternal and child health areas.

Problems of the Bangladeshi Healthcare Sector:

- Scarcity of healthcare professionals including physicians, nurses, technicians, pathologists and pharmacists etc.

- Rural vs. urban gap.

- Lack of modern equipment and operators.

- Poor management of public sector hospitals.

- The extremely high price of private sector healthcare facilities.

Recommendations:

- An increasing number of healthcare professionals along with physicians, nurses, technicians, pathologists, and pharmacists, etc. with a priority basis.

- Providing special incentives to rural healthcare professionals.

- Facilitating easy procurement of healthcare equipment.

- Root out corruption in public hospitals.

- Skilled development of the public sector healthcare professionals.

- Fiscal and non-fiscal support should be offered to increase the number of enterprises in the healthcare sector.

- Educational Services Sector:

The education system in Bangladesh consists of 5 years of Primary Education (grades 1–5), 3 years of junior or lower Secondary Education (grades 6–8), 2 years of Secondary Education (grades 9–10), 2 years of senior or higher Secondary Education (grades 11–12), 4 years bachelor and 1-year master or tertiary education.

In terms of education improvements, Bangladesh’s improvements in enrollment access are generally in line with those of its South Asian neighbors (e.g., better than Pakistan, comparable to Nepal, and less than India). Its recent PE gross enrollment rate (GER) of 99% increased from 90% in the late 1990s [13]. Although its recent PE net enrollment rate (NER), SE GER, and SE NER (91%, 50%, and 39%, respectively) also increased substantially from the late 1990s levels (81%, 35%, and 29%, respectively), further improvements are needed.

There are around 80,000 primary schools enrolling over 5.0 million students and 17,000 high schools enrolling 7.0 million students. Besides, there are over 1200 intermediate colleges, 38 public universities, and 91 private universities in Bangladesh. About 70 percent of children in Bangladesh, It is shocking to find that from Grade VI, the dropout rate starts at 10 percent, and by Grade X; it rises to 65 percent to 70 percent, at the maximum.

Problems of the Bangladeshi Healthcare Sector:

- Reducing absenteeism, and dropout rates from, secondary to tertiary levels.

- Low teacher-student ratio,

- Inadequate quality-enhancing training facilities for teachers

- Substandard early childhood education

- Absence of skilled teachers at all levels

- Absence of research facilities

- Absence of industry-academia linkage

- Absence of demand-driven education facility

- Scarcity of technical and vocational education institutes

- Minimum number of seats in public sector professional/technical and vocational institutes

Recommendations:

- Providing emphasis on technical/vocational/professional education.

- Producing more skilled teachers and offering handsome benefits to them.

- Increasing research funds for teachers and students.

- Establishing functional laboratories for enriching education standards.

- Establishing industry-academia linkage

- The demand-driven sector-specific curriculum should be introduced.

- Increasing seats in public sector institutes to facilitate higher education for the poor.

- Pharmaceuticals Sector:

Pharmaceutical is one of the SME Booster Sectors having the special attention of the policymakers due to its growth potential. In the 1970s three fourth of the pharmaceutical industry was dominated by multinational companies. Local pharmaceutical companies started initiation in the 1980s and have grown in the last two decades at a considerable rate. The National Drug Policy (NDP) in 1982 and 2005 has had a major impact on the development and growth of the Bangladesh pharmaceutical sector of Bangladesh.

The Bangladeshi pharmaceutical industry is dominated by the local manufacturers. Local vs. multinational companies has 97% vs. 3% market shares. The top ten market leaders of the Bangladeshi pharmaceuticals sector are local companies. Square and Incepta pharma have 30% of local market shares. The size of the retail market reached BDT 84.0 billion (US$ 1.136 billion) in 2011 based on IMS health Bangladesh (Haroon, 2012). The report additionally stated that retail sales in the domestic market achieved 23.59% growth in 2011 which is following 23.8% and 16.8% growth in 2010 and 2009 respectively. This industry has an annual growth rate of 10.2% during the fiscal year 2002. The values fell by 4.3% in 2003. The lower growth rate shown in 2003 and 2004 is large because of the country’s economic recession. Again the growth rate increased by 9% in 2005. The growth rate in 2005 was 17.5%. In recent times the growth rate has literally doubled which is 23.59% in 2011 [14].

According to the Directorate General of Drug Administration (DGDA), there are currently 200 active allopathic companies in Bangladesh. About 22,000 brands of drugs are sold which cover 1500 types of medication. There are 1495 wholesale drug license holders and about 37700 retail drug license holders. The industry meets 98% of the demand for medication in the country and can be considered to be self-sufficient.

The sector employs 1, 15,000 workers and between 2013 and 2014, the growth stood at around 11.37%. According to IMS Health, annual pharmaceutical sales in the local market may reach BDT 160 billion within 2018 [15].

Current Trend:

According to IMS Health, the top 10 companies hold 68.5% market share, the top 20 hold 85.73%, and the top 31 hold 94.1%, while the remaining 169 companies shared 5.9% among them. Square Pharmaceuticals led the industry with a market share of 19.21%. Incepta and Beximco took 2nd and 3rd positions with market shares of 10.42% and 8.47% respectively.

Currently, formulations are exported to 107 countries around the world. The major destinations for Bangladeshi medicines are Germany, the USA, France, Italy, the UK, Canada, Netherlands, Denmark, Myanmar, Sri Lanka, and Kenya, while nearly 50 countries import Bangladeshi medicines regularly. The growth in exports has averaged over 10% from 2010 to 2014. In 2015, the exports were over $ 41.17 million. Pharmaceutical companies are trying to export to regulated, unregulated, and moderately regulated markets.

Problems of the Bangladeshi Pharmaceuticals Sector:

- The sector is at a competitive disadvantage, as pharmaceutical players still have to import 90% of raw materials from 98 indenters around the world.

- The API Park which was supposed to be established has been delayed.

- The domestic market is too small to justify an API manufacturing plant other than the reduction of cost.

- This sector may face a disadvantageous environment while the TRIPS agreement will be applicable to Bangladeshi pharmaceutical sector after 2032.

- Minimum export earnings against the invested amount in comparison with other sectors.

Recommendations:

- Local companies should produce world-class medicine that can attract demand from the global market and increase export earnings.

- Establishments of joint venture projects may facilitate technology transfer.

- The API Park should be completed as early as possible with the intervention of the government.

- A strong export network shall be developed to ensure the export of API products abroad.

- Increasing R&D for innovating own products to face most 3032.

- Fashion Design Sector:

Bangladesh is proud to have a variety of handmade crafts like Jamdani, Rajshahi silk, and Reshmi silk. Perhaps, the most famous yarn from this part of the subcontinent is Dhaka Muslin, a superfine silk yarn embellished with intricate hand embroidery. Most of the designers of Bangladesh run their own boutiques and produce not only for a local clientele but have participated in various international fashion events. But the fashion design of Bangladesh is struggling to strengthen its position in the international market.

The general problem in Bangladeshi textile production is the small number of available fashion designers. It is difficult to know how many there are, as there is no organization for fashion designers. The lack of fashion designers also means that whenever a designer, trained in-house, moves to a new place leaving the former with no expert hand In “The buyer model,” the buyer brings materials and designs, often the patterns, to the producer. The producers learn how to make one particular design, but they neither learn anything about the market research and trend analysis underlying the design nor the actual act of designing and the design management process.

Current Trend:

The domestic Fashion market of Bangladesh is also dominated by Indian designers. The local market is over-flooded with Indian serial-based fashion wear in different festivals like the Eid-ul-Fitre, Bengali New Year, and Puja of the Hindu community. There are three sub-sectors of the domestic fashion design sector. These are:

- Handloom / Power-loom Sub-sector:

Used to produce Jamdani, Benarasi, Tangail Sharee (Cotton saree, Half Silk, Soft Silk, Cotton Jamdani, Gas-mercerized twisted cotton saree, Dangoo sharee, Balucherri) Handloom Cotton share, Lungi, Silk share, Gamcha, Check Fabrics, Mosquito Nets, Bed Sheet & Bed Cover, Sofa Cover, Rakhine Special Wear (Wooling Shirting, Woolen Bed Sheet, ladies chadar, Bag, Lungi and Thami for tribal ladies), Tribal Fashion Wear (Thami for tribal ladies, Khati (Orna), Ladies Chadar & Lungi, Miniouri Fashion Garments (Monipuri Sharee, Punek for ladies like lungi, Lungi, Un-stitched cloth (three pieces), Innachi (Orna) & Vanity Bag etc.

- Local Boutique Sub-sector:

The boutique sector started its journey soon after the independence of the country. But this sector got its momentum in the late 90s and currently, there are nearly 300 large-scale boutiques in the country, and out of these, there are 50 branded Boutiques. Boutiques in Bangladesh sell fashionable and trendy items like garments, jewelry, handbags, and accessories. However, the majority of them sell trendy clothing, which has got maximum demand. Some boutiques sell products for all segments of people – women, men, and for children. However, some others may have specialties, as you often can find boutiques exclusively for women & children, or for men. There can be boutiques exclusively for women as well. Many boutiques specialize in hand-made or one-of-a-kind items.

Boutiques may have specializations in terms of products. For example, some boutiques can be specialized in young ladies’ dresses; some may have specializations in Sarees. Similarly, some Indian boutiques may have exclusive stocks of various types of Punjabis. The customers of boutiques are mostly from higher and upper-middle-class families who starve for fashion. They are mainly the segment of people who have enough disposable income to spend on fashion and entertainment.

Boutique houses can also be classified as stand-alone or chain. Stand-alone boutiques generally have a single owner and location. Chain boutiques are owned by a larger company and can be located in wealthy areas of both home and abroad. They may even be located within a larger department store or shopping center.

- Handicrafts Sub-sector:

Handicrafts are mostly defined as “items made by hand, often with the use of simple tools, and are generally artistic and traditional in nature. They are also objects of utility and decoration. Some common types of handicrafts are Textile based handicrafts, Clay, Metal, Jewelers, Woodwork, Stone Craft, Glass, and Ceramic.

Handicrafts are mostly defined as “items made by hand, often with the use of simple tools, and are generally artistic and traditional in nature. They are also objects of utility and decoration. Some common types of handicrafts are Textile based handicrafts, Clay, Metal, Jewelers, Woodwork, Stone Craft, Glass, and Ceramic.

There is no exact survey about the number of handicraft units in the country. However, Banglcraft, an organization of the Handicraft owners enlisted around 214 associate members and 109 ordinary members. Most of the handicraft manufacturing units are small and located in rural areas. The manpower of some of the units is as low as 2-5 including the owner while a lot of units have a workforce of around 20 people, however, there are some units that have a large number of people working for them (see table-2).

Most handicraft enterprises use traditional techniques without the use of modern tools or instruments. The total workforce associated with the industry stands at approximately over 3 million of which over three-quarters are employed in the textile, jute goods, wood, lather, cane, and bamboo. These are followed by metal-works and pottery. A rough estimate shows that exports occupy about 20% of the total production.

Problems of the Bangladeshi Fashion Design Sector:

- There is a small number of qualified product designers available in the domestic fashion sector.

- The clients bring their own design concepts but are not much concerned about the quality of the design. There is, therefore, no demand for quality design work. The demand is mainly for cheaper work. This is the reason why designers with fine arts backgrounds do not stay in the same design house. They receive salaries lower than their

- The export market is buyer/buying house dependent. They bring in their own designs for production in Bangladesh.

- The hand / Power loom sector has limitations in dyeing knowledge and is unable to dye different lots with the same shade.

- Boutique factories are unable to produce large volumes of products in a uniform design and shape.

- Unable to produce uniform products on a large scale within a short lead time.

- Local fashion industries have limitations in buyer searching and export procedure to enter into the export market.

Recommendations:

- Qualified designers have to be developed.

- Existing technologies in the fashion sector have to be updated for increasing product quality and productivity.

- Dyeing technology in the fashion sector has to be updated with modern machinery and techniques.

- Uniformity of production has to be achieved to get export orders.

- A special initiative has to be taken to search the export market and get orders from international buyers.

Linking up domestic fashion houses with textiles and the readymade garment sector could enlarge the value chain and increase value addition.

Top 11 Industrial Sectors in Bangladesh, this is the summary of two chapters of the book “The Mirror of Bangladesh Economy” of the Author. To purchase the book click here.

*Author’s Short Profile:

Mr. Md. Joynal Abdin is a Business Consultant & Digital Marketer based in Dhaka, Bangladesh. He is also the Co-Founder & CEO of the Bangladesh Trade Center. Previously he served at the Dhaka Chamber of Commerce & Industry (DCCI) as Executive Secretary; DCCI Business Institute (DBI) as Executive Director; SME Foundation as Deputy Manager; and the Federation of Bangladesh Chambers of Commerce & Industry (FBCCI) as Assistant Secretary.

The list of services Mr. Abdin is offering includes but is not limited to Business Research and Documentation like Feasibility Study, Project Proposal Preparation, Writing Business Manual, Standard Operating Procedures, etc.; Export Market Selection and Product Positioning at Home and Abroad; Buyers-Sellers Matchmaking; Website Development; Search Engine Optimization (SEO); and Social Media Marketing, etc.

Top 11 Industrial Sectors in Bangladesh, this is the summary of two chapters of the book “The Mirror of Bangladesh Economy” of the Author. To purchase the book click here.